Tokenized assets transform traditional investments—real estate, art, commodities—into blockchain-based digital tokens that fractionally divide ownership into tradeable units. A $10 million commercial property becomes 10,000 tokens worth $1,000 each, enabling retail investors to access previously exclusive institutional markets. Security tokens represent equity positions, while NFTs authenticate unique collectibles. This mechanism eliminates intermediaries, enhances liquidity through 24/7 trading, and democratizes investment access, though regulatory ambiguity and technological complexity present notable implementation challenges that warrant deeper examination.

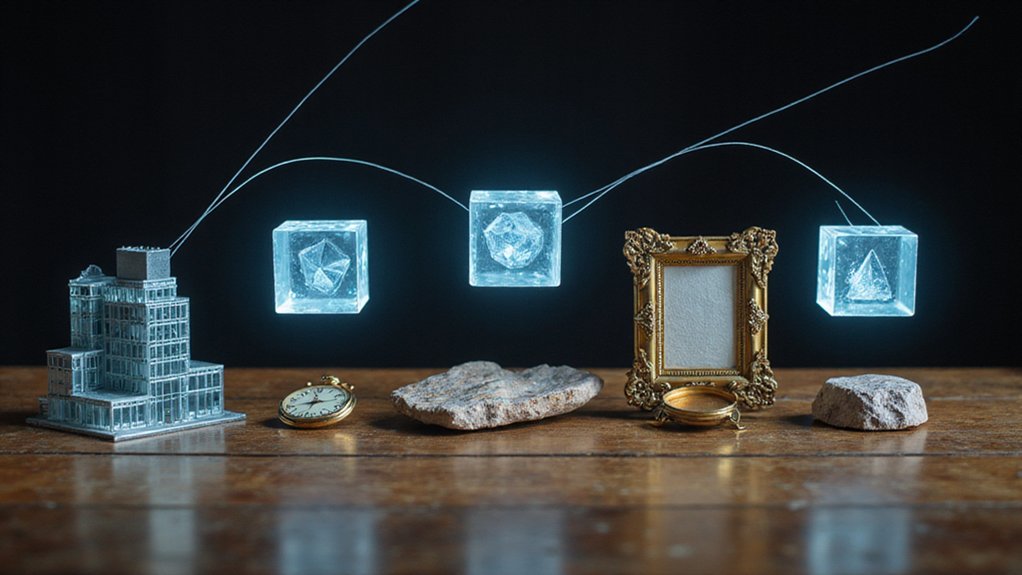

The notion that a Picasso painting or a Manhattan penthouse could be sliced into digital fragments and traded like baseball cards might have seemed preposterous a decade ago, yet tokenized assets have emerged as one of the most compelling applications of blockchain technology.

These digital representations of traditional assets transform ownership into programmable units recorded on distributed ledgers, fundamentally altering how investors access and trade everything from real estate to fine art.

Tokenization operates through a surprisingly elegant mechanism: physical or intangible assets are converted into digital tokens that represent fractional ownership rights.

The transformation of tangible wealth into programmable digital fragments represents blockchain’s most graceful disruption of traditional ownership models.

A $10 million commercial property, for instance, might be divided into 10,000 tokens worth $1,000 each, allowing retail investors to participate in markets previously reserved for institutional players.

This democratization occurs through various token structures—security tokens for equity positions, NFTs for unique collectibles, utility tokens for service access, and payment tokens for transactional purposes.

The benefits extend beyond mere accessibility.

Blockchain infrastructure eliminates traditional intermediaries, reducing friction and transaction costs while enhancing liquidity through 24/7 trading capabilities.

Fractional ownership transforms illiquid assets into tradeable securities, theoretically improving price discovery and market efficiency.

The transparency inherent in blockchain networks provides immutable ownership records, addressing age-old problems of provenance and authenticity.

However, this digital utopia faces sobering realities.

Regulatory frameworks remain frustratingly ambiguous, creating compliance headaches for issuers and uncertainty for investors.

Technological complexity demands significant expertise, while scalability limitations constrain widespread adoption.

Security risks persist—after all, blockchain’s immutability becomes a liability when smart contracts contain vulnerabilities or private keys are compromised.

The tokenization process typically begins with asset selection and valuation, followed by token creation through initial coin offerings or security token offerings.

Blockchain integration guarantees transparency and security, while secondary market trading provides liquidity.

Regulatory compliance, though challenging, remains essential for legitimacy.

Real-world applications span diverse sectors: real estate tokenization enables property investment with minimal capital requirements, while art tokenization allows collectors to own fractions of masterpieces.

Investment funds and commodities increasingly embrace tokenization for enhanced accessibility and reduced barriers to entry, suggesting that yesterday’s preposterous notion may indeed reshape tomorrow’s financial landscape.

Gaming NFTs represent a rapidly expanding segment of the tokenized asset ecosystem, with layer 2 scaling solutions improving transaction speeds and security for digital collectibles and in-game assets.

The most significant potential lies in tokenization’s ability to completely replace traditional validation methods such as physical deeds, paper titles, and copyright certificates with immutable blockchain records.

McKinsey analysis predicts the tokenized market will reach a $ trillion valuation by 2030, excluding cryptocurrencies entirely.

Frequently Asked Questions

What Are the Tax Implications of Owning Tokenized Assets?

Tokenized asset ownership triggers capital gains taxation upon disposition, with holding periods determining short-term versus long-term treatment rates.

The IRS classifies these digital representations similarly to cryptocurrencies, requiring meticulous transaction documentation.

Receiving tokens as compensation constitutes ordinary income at fair market value.

Jurisdictional complexities arise when tangible assets become intangible tokens, potentially circumventing traditional transfer taxes—though tax authorities remain predictably unamused by such creative interpretations of ownership structures.

How Do I Buy and Sell Tokenized Assets on Exchanges?

Investors access tokenized assets through specialized exchanges that support security tokens, requiring standard KYC compliance (because apparently even digital fractional ownership demands paperwork).

These platforms list tokenized real estate, stocks, or commodities paired with major cryptocurrencies like Bitcoin or Ethereum.

Smart contracts automate transactions while market makers provide liquidity—though regulatory uncertainty across jurisdictions creates interesting navigation challenges for those seeking exposure to traditionally illiquid assets.

What Happens if the Blockchain Network Goes Down Temporarily?

When blockchain networks experience temporary outages, tokenized asset trading grinds to a halt—though the underlying data remains mysteriously intact, safely distributed across countless nodes.

Users face the peculiar modern inconvenience of watching their digital property become temporarily inaccessible while the immutable ledger preserves every transaction detail.

Trading resumes once connectivity returns, typically creating transaction backlogs that clear relatively quickly, assuming investors haven’t panicked meanwhile.

Are Tokenized Assets Insured Against Theft or Technical Failures?

Insurance coverage for tokenized assets remains frustratingly patchy, with traditional insurers still grappling with how to underwrite digital ownership claims.

While some custodial services offer limited protection against theft, thorough policies covering smart contract failures or blockchain vulnerabilities are scarce.

Most tokenization platforms rely on security audits and permissioned networks rather than actual insurance—a somewhat ironic situation where cutting-edge assets lack old-fashioned risk protection.

Which Countries Have Banned or Restricted Tokenized Asset Trading?

Several countries have implemented outright bans on tokenized asset trading, including China, Bangladesh, Algeria, Nepal, and Afghanistan, citing financial stability concerns and fraud prevention.

Others maintain restrictive regulatory frameworks—the United States through SEC oversight, the European Union via MiCA regulations, and the UK through FCA supervision.

Saudi Arabia, Tunisia, Pakistan, Bolivia, and Egypt have imposed various prohibitions, while Singapore and Indonesia adopt more measured approaches balancing innovation with risk management.